Startups start here.®

Silicon Catalyst is the only incubator + accelerator focused on the Global Semiconductor Industry including Chips, Chiplets, Materials, IP and Silicon fabrication based Photonics, MEMS, Sensors, Life Science and Quantum.

We have engaged with more than 1,500 semiconductor startups worldwide and have admitted over 150 exciting companies. In addition, our UK government funded early-stage incubator completed its second cohort of 10 startups in March 2025 and has just begun incubating its third cohort.

Our companies participate in a 24-month customized incubation program. Each is guided closely by a Silicon Catalyst partner. This includes a semiconductor focused curriculum and over 40 events worldwide each year. Silicon Catalyst’s ecosystem provides everything our startups need to design, fabricate, and market semiconductor solutions:

• In-Kind Partners (TSMC, Synopsys, Arm, ST, MathWorks and over 60 more) – provide each startup several millions of dollars’ worth of goods and services including EDA tools, IP, PDKs, prototypes, design and test services, packaging and business solutions. Our companies have received over $150M in in-kind goods and services.

• Strategic Partners (TI, ON Semi, Soitec, Bosch, Cirrus Logic, Arm, ST Micro, Sony, EMD Electronics, NXP, Mayfield, DuPont, GlobalFoundries and SMD Semiconductor) – participate in the selection process and actively look for opportunities to partner with our startups.

• Investors – Our partnership with Mayfield and a large group of over 400 VCs, Angels, Angel groups, Corporate VCs, and Family Offices fund each journey. Silicon Catalyst Angels, created from our ecosystem, also funds our companies. In February of 2024, Silicon Catalyst Ventures (SCV) was launched to fund early-stage startups accepted into the incubator’s two-year program. SCV has already made 26 investments in Silicon Catalyst Portfolio Companies. Our companies have received over $600M in venture investments.

• Advisors – A valuable network of over 350 industry experts that we match to the specific needs of each startup.

• Universities, Industry Organizations, Accelerators and Government Agencies – We nurture over 400 partner relationships for the benefit of our portfolio companies. Our companies have received over $100M in grants.

Silicon Catalyst’s mission is to help semiconductor startups succeed.

Join us in driving innovation!

Apply now.

Welcome! And thank you for your interest in the Silicon Catalyst incubator. The purpose of your application is to help us determine if we will be able to accelerate your business through our ecosystem of In-Kind Partners, investors, and Advisors. Our team will use your application to evaluate your technology and your business model. Please make your answers as comprehensive as possible.

Alternatively, if you would like to talk with us before applying, please send an email to webinfo@siliconcatalyst.com and we can arrange an introductory meeting or phone call.

Click here for application tips. We look forward to reviewing your application.

Application FAQ

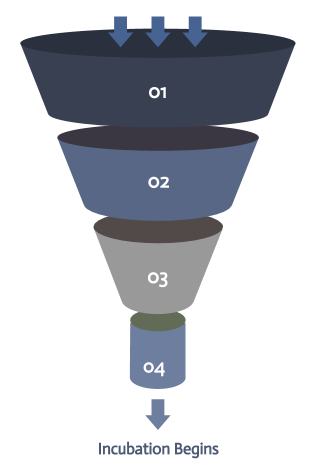

What should I expect once the application is completed?

Our team will review your application, and one of our team will set up a phone or video call to answer your questions and to have an initial discussion about your company and technology.

If there is mutual interest in working together, we will pull in a small number of our Advisors to help our team perform due diligence on your company.

If your company is selected based on the due diligence, you will pitch at a Pre-Screening event with 12-15 of our highly technical industry advisors (we have two Pre-Screening events per year).

If your company is selected from the Pre-Screening event, you will then pitch at a Screening event to 50+ Advisors, investors, and partners (we have two Screening events per year).

If your company is selected from the Screening event you will be offered admission to the Silicon Catalyst incubator.

How important is it to answer all the questions on the application?

For the initial screening, your answers are all we have to evaluate your application so it’s in your best interest to make your answers as comprehensive as possible. Even if the information is included in your pitch deck, answering the application questions completely is generally the most effective way to communicate this information to Silicon Catalyst.

How does Silicon Catalyst decide which startups to admit?

The bottom line is we’re looking for high-quality, interesting startups that can have a significant impact on the world, that have a good chance to succeed, and that we can help. More specifically, we consider 11 criteria:

Capable team

Open to mentoring/coaching

Needs Silicon Catalyst ecosystem (in-kind tools and services, advisors, investors)

Addresses large problem/pain point

Differentiated technology/solution with IP protection

Large market opportunity

Traction with potential customers and partners

Realistic, thorough financial plan

Attractive business model/returns

Clear technical and business project timelines/milestones

Plans in place to address issues and gaps

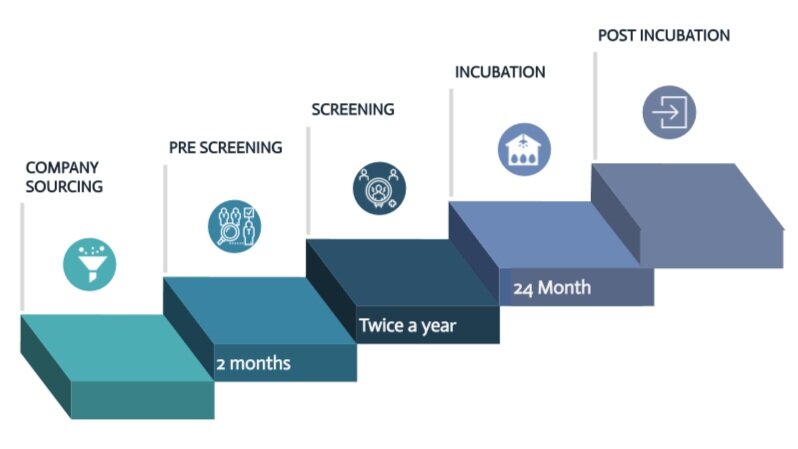

What is the application/incubation process of Silicon Catalyst?

Silicon Catalyst Incubator

Incubator Selection Process

1. Sourcing

Companies are sourced from Silicon Catalyst Ecosystem

2. Review Application

Companies apply to Silicon Catalyst via ProSeeder

3. Prescreening

Silicon Catalyst Ecosystem members review companies

4. Screening

A large group of ecosystem members will review applicants to determine best fit for Silicon Catalyst incubator admission

Silicon Catalyst Incubation Process

Beginning of Incubation

Develop a customized 24 month incubation plan covering the following:

Advocate and Advisor engagement

Product Market Fit

Operational Planning

Fundraising

Supported by curriculum

During Incubation

Regular interaction with a dedicated Silicon Catalyst advocate and Advisors

Development of comprehensive fundraising deck

Periodic status update to ecosystem

Assist with staffing

Application Tips

A well-prepared application and a clear, thorough, and concise pitch deck are critical to your success as a company. The tips below will help you provide the information that Silicon Catalyst, as well as virtually any angel group or venture capital firm, needs to evaluate your company.

Problem or opportunity statement

What is the problem or opportunity that your product can uniquely solve?

Solution/product to be developed

What is the product you will create that will address the problem or opportunity? What is your value proposition?

Use of semiconductors in solution, semiconductor type

Will your company design a unique integrated circuit (IC) chip? What type of IC will you design (e.g. digital, analog/mixed-signal, memory, MEMS, silicon photonics, etc.). What technology node will you use (e.g. 0.18 micron, 65nm, 7nm, etc.)?

Potential market size (initially and ultimate)

What is the size of the market you will directly target, defined by TAM (Total Available Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market)? TAM, SAM, SOM overview

Current or expected customers

Identify your current customers or potential customers that fit into your SOM (Serviceable Obtainable Market).

Describe your business model

What is your revenue model and pricing strategy? Explain your sales distribution method.

Competitors and alternatives

Define the competitive landscape, existing companies, up and coming players, alternatives. Look beyond today to the time period when your company will be in production and selling in your market.

Competitive advantage

How is your product better/cheaper/disruptive/etc.

Intellectual property (owned or licensed)

List intellectual property both applied for and granted.

Go to market strategy (Marketing and Sales)

How do you reach your customer? Direct Sales/Channel partners. What is your customer acquisition cost (CAC)?

Current and desired Partnerships

Who will you work with to make your product and company a success? Who have you already reached an agreement with?

Feasibility demonstrations

Do you have a minimum viable product (MVP)/simulations? What can you show us to convince us you have a viable product?

Key future technical and customer milestones and deliverables

These should be measurable and trackable milestones and deliverables.

What are your biggest challenges?

Clearly defining your challenges will allow us to access our ability to help you mitigate those challenges.

What are your greatest perceived risks?

How did you hear about Silicon Catalyst?

What do you expect from Silicon Catalyst?

For example, In-Kind Ecosystem Partner tools and services, connection to the Silicon Catalyst Advisor network, funding support, engagement with Silicon Catalyst Strategic Ecosystem Partners, etc.

Current cash balance and monthly cash burn rate

Include your runway (that is, how long until you run out of cash?).

Previous funding and capital raised, and from whom

Amount of funding needed in 12 and 24 months

Primary expected expenses by major category

Salaries, IP, prototyping, design tools, 3rd party services, office space, IT

Exit strategy

licensing, acquisition, IPO

Income or Revenue expected in 12 and 24 months- describe the source.

Stage

Idea, Incorporated, Seed funded, Series A

Management

List your current employees as well as advisors.